Starting with the 2025 tax year, the rules around crypto reporting get a major upgrade. U.S. “brokers” (think centralized exchanges) must report gross proceeds from digital-asset sales to the IRS on the new Form 1099-DA for transactions occurring on or after January 1, 2025, with forms expected to land in early 2026 for your 2025 activity. This is the biggest visibility jump yet for tax authorities and it affects how every U.S. trader keeps records and files.

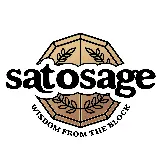

In this guide, you’ll get a crisp breakdown of Binance.US vs. Binance.com (who reports, who doesn’t), exactly what’s changing with 1099-DA, and how to stay compliant, even if you never receive a form. Short version: Binance.US , the U.S.-regulated platform, falls under these new reporting rules, while the global Binance.com platform doesn’t report to the IRS and isn’t for U.S. persons; either way, you’re still obligated to report your gains, losses, and income.

Disclaimer: This article is for educational purposes only and is not tax advice. Consult a qualified tax professional for guidance specific to your situation.

Does Binance Report to the IRS?

Quick Answer (one sentence):

Yes, Binance.US reports to the IRS and will expand reporting via Form 1099-DA for 2025 activity; Binance.com doesn’t report to the IRS and isn’t for U.S. persons, but you must still report your taxes.

Binance.US vs. Binance.com

- Binance.US = U.S.-regulated entity; IRS reporting applies.

- Binance.com = Not for U.S. persons; no direct IRS reporting.

2025 Shift: Form 1099-DA begins (scope + timing).

Starting with transactions on or after Jan 1, 2025, U.S. brokers (including Binance.US) report gross proceeds, transaction type/date, fair market value, and broker/account details on Form 1099-DA, with forms expected to be issued in early 2026 for TY2025.

Who This Affects: U.S. taxpayers using Binance.US (residency/KYC implications).

If you’re a U.S. taxpayer trading on Binance.US, your reportable sales/exchanges fall under the new broker rules, and you’re obligated to file correctly regardless of whether you receive a form.

Edge Notes: VPN/use restrictions; enforcement risk if misused.

Using a VPN to access geo-restricted platforms doesn’t make activity invisible, blockchain analytics can trace transactions and tie wallets to identities, and misuse may violate platform terms.

What Does Binance.US Report?

Pre-2025: 1099-MISC for $600+ income (rewards/airdrops; not all trades).

Before the 2025 rules kick in, Binance.US typically issued Form 1099-MISC when a user earned $600 or more in staking, referral rewards, or similar income. Routine buy/sell trades generally weren’t on that form, you still had to self-report gains/losses.

Starting Jan 1, 2025: 1099-DA details

For transactions on or after Jan 1, 2025, U.S. crypto brokers (including Binance.US) will issue Form 1099-DA. For tax year 2025, the form focuses on gross proceeds and key transaction facts; cost basis reporting is slated to phase in from 2026.

- Reported fields (TY2025): gross proceeds, transaction type, transaction date, fair market value, and broker/account identifiers (basis not required for 2025).

Delivery: sent to you + IRS for Tax Year 2025 (filed 2026).

Expect the first 1099-DA to arrive in early 2026 for your 2025 activity, copies go to you and the IRS.

Scope Clarifiers

- Cashing out vs. crypto-to-crypto, NFTs, fees, and adjustments (what appears). For 2025, sales/exchanges (including crypto-to-crypto and certain NFTs) are reported by gross proceeds; basis/adjustments/fees aren’t netted on the form until 2026 basis reporting begins.

- Transfers in/out & self-custody. Moving assets between wallets you control isn’t a taxable event by itself; keep records for basis tracking and reconciliation across platforms.

IRS Rules: You Must Still Report Your Binance Activity

Report Even Without a 1099

You must report crypto gains, losses, and income on your return even if you never receive a tax form from an exchange, answer the digital-asset question and file the details each year.

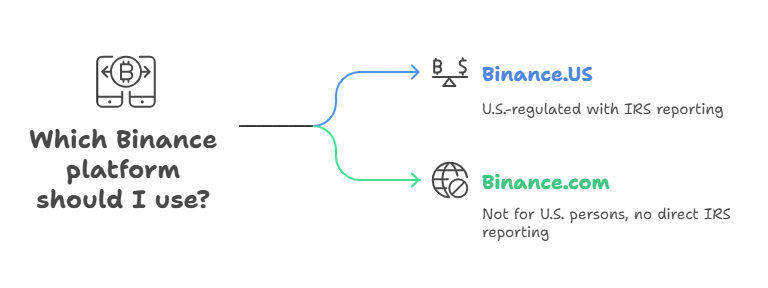

Taxable Events List

- Sells and swaps/crypto-to-crypto exchanges

- Spending crypto on goods/services

- Rewards & airdrops (ordinary income when received)

- Interest/staking earnings (ordinary income when received)

These categories are recognized in IRS guidance and practitioner explainers; you must calculate proceeds/income and then any gains or losses.

How the IRS Enforces

- Uses blockchain analytics and third-party information to trace activity and cross-check filings.

- Mismatch or underreporting can trigger CP2000 notices and, in some cases, audits.

Consequences for Non-Compliance

Expect potential penalties, interest, and accuracy-related adjustments if income or gains are omitted or misreported, another reason to keep thorough records and reconcile all wallets/exchanges.

How to Access Your Binance.US Tax Forms

Where to Find Forms: 1099-MISC (prior years), 1099-DA (TY2025+).

- Go to Binance.US, Tax Statements (web or app) to see available tax docs. Prior years’ 1099-MISC (for $600+ staking/referral rewards) live there, with step-by-step “How to download 1099-MISC” in the Help Center. When 1099-DA begins for Tax Year 2025, expect it to surface in the same Tax portal. If you don’t have a form, use your full transaction history and tax software to file.

Export Transactions: CSV/API export; full history for basis/reconciliation.

- From Export Reports in your account, generate Custom Reports or Tax Reports and download as CSV (or PDF) for all trades, deposits/withdrawals, distributions, etc. You can also create a Tax API key to sync data directly to tax software.

Use With Tax Software: approved partners/integrations; import tips; reconcile staking.

- Binance.US provides a Tax API and Help Center guides for connecting to trusted platforms (e.g., CoinTracker/others) via API or CSV. Tools like CryptoTaxCalculator and CoinTracking support Binance.US imports and generate reports (Form 8949/Schedule D exports, TurboTax-ready files), helping reconcile staking/rewards and trades across wallets.

Recordkeeping Checklist (keep these on file):

- All wallets/exchanges you used (addresses + labels).

- Deposits/withdrawals (with tx hashes), buys/sells/swaps, distributions.

- Fees and notes on cost-basis method (FIFO/Specific ID), plus any staking/reward income logs.

Key Takeaways for U.S. Binance Users

- Binance.US reports qualifying data, with expanded detail via Form 1099-DA starting for 2025 transactions.

- Binance.com doesn’t report to the IRS, and U.S. persons shouldn’t use it due to regulatory restrictions.

- You must report all taxable crypto events, forms or no forms (sells, swaps, spending, rewards, staking, airdrops).

Sidebar / Callouts

Timeline Card: 2023–2026

- Aug 2023: IRS/Treasury release proposed broker-reporting regs for digital assets.

- 2024: Agencies refine guidance; industry prepares for form and data changes.

- Jan 1, 2025: Reporting regime begins for sales/exchanges occurring in 2025; Form 1099-DA becomes the standard for gross proceeds.

- Early 2026: First 1099-DA forms issued for Tax Year 2025 activity.

- 2026 onward: Staged expansion toward basis reporting (phased implementation).

DeFi / Non-Custodial Note (evolving treatment, watch for updates)

Current rules center on brokered transactions; treatment for DeFi/non-custodial platforms remains in flux, with policy actions and legal developments continuing in 2025. Track IRS notices and legislative updates before filing.

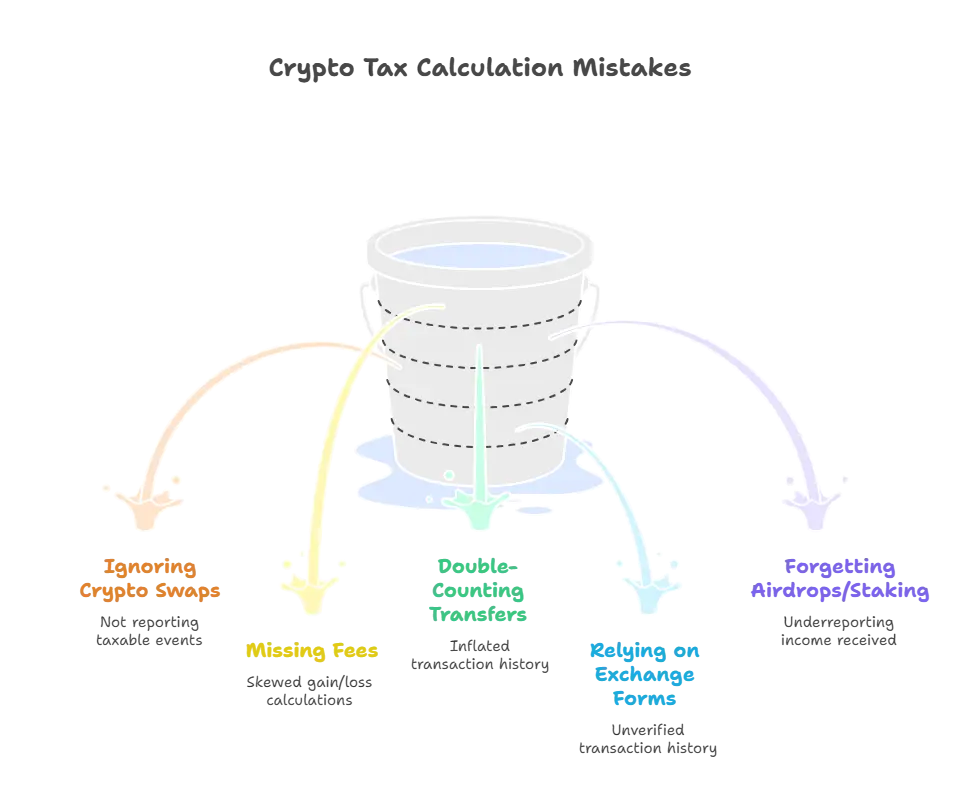

Common Mistakes (avoid these):

- Ignoring crypto-to-crypto swaps as taxable events.

- Missing fees in your gain/loss calculations.

- Double-counting transfers between your own wallets/exchanges.

- Relying solely on exchange forms, always reconcile with your full history.

- Forgetting to record airdrops/staking as income when received.

“This article reflects rules for the 2025 tax year; verify any updates before filing.”

“This is educational content, not tax advice.”